Empowering Donors: Myoin Society Achieves Section 80G Tax Exemption Approval

We are thrilled to announce that Myoin Society has been granted provisional approval under Section 80G of the Income Tax Act, 1961, on October 22, 2025. This milestone achievement opens new avenues for supporters to contribute to myositis research while benefiting from significant tax deductions.Myoin-80G-Certificate.pdf

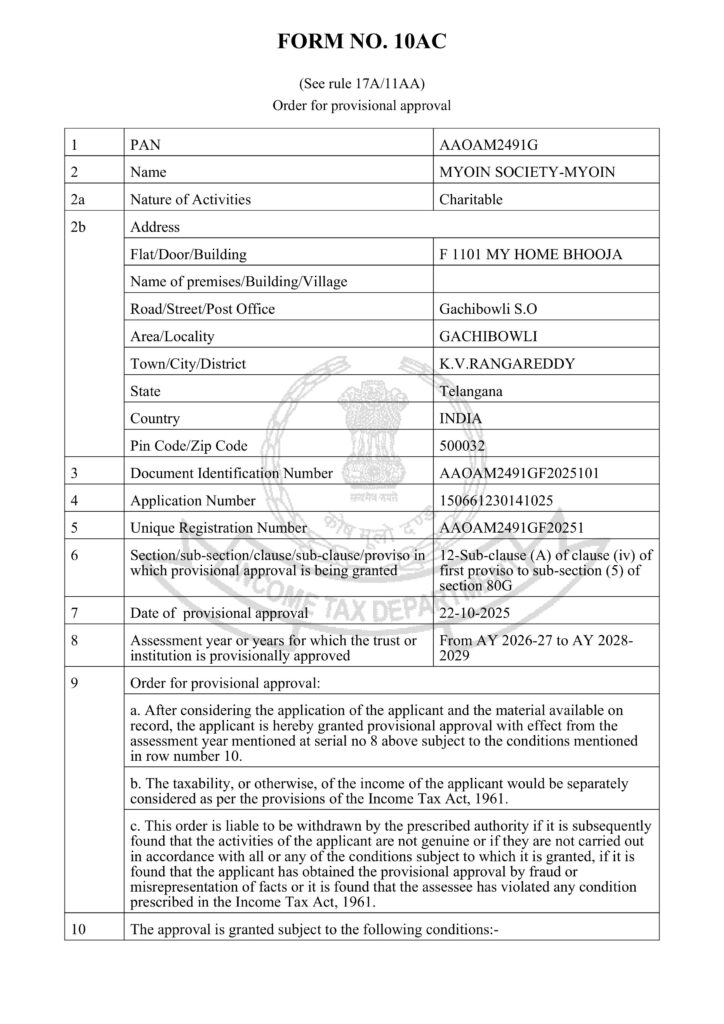

Our 80G Registration Details:

- Approval Date: October 22, 2025Myoin-80G-Certificate.pdf

- Unique Registration Number: AAOAM2491GF20251Myoin-80G-Certificate.pdf

- Document ID: AAOAM2491GF2025101Myoin-80G-Certificate.pdf

- Validity: Assessment Years 2026-27 to 2028-29 (3 years)Myoin-80G-Certificate.pdf

- PAN: AAOAM2491GMyoin-80G-Certificate.pdf

What This Means for Our Donors:

Tax Deduction Benefits: Donors can now claim 50% tax deduction on donations made to Myoin Society. For example, if you donate ₹10,000, you can reduce your taxable income by ₹5,000, resulting in substantial tax savings.

Cash Donation Guidelines: To qualify for deductions, donations exceeding ₹2,000 must be made through cheque, bank transfer, or digital payment methods – not cash. This ensures transparency and proper documentation.

Donation Receipts: All donors will receive official receipts with our 80G registration number and PAN details, enabling easy tax filing and deduction claims.

Impact on Our Mission:

Increased Donor Confidence: The 80G certificate enhances our credibility and transparency, assuring donors that their contributions will be used exclusively for genuine charitable purposes in myositis research and patient care.

Expanded Fundraising Capacity: With tax benefits as an incentive, we can attract individual donors, corporate sponsors, and institutional funders who seek tax-efficient giving opportunities.

Enhanced Social Impact: The additional funding generated through tax-incentivized donations will enable us to:

- Expand multi-center myositis research projects

- Develop comprehensive patient support programs

- Train more healthcare professionals in myositis diagnosis and treatment

- Strengthen our pan-India collaborative network

Compliance and Transparency:

This 3-year provisional approval (AY 2026-27 to 2028-29) comes with strict compliance requirements. We are committed to:Myoin-80G-Certificate.pdf

- Annual filing of donation statements and financial reports

- Proper documentation of all charitable activities

- Transparent use of funds exclusively for stated objectives

- Timely renewal applications to maintain continuous approval

Perfect Timing with Our Other Achievements:

Combined with our recent DARPAN registration (TS/2025/0799367) and Section 12A income tax exemption (AAOAM2491GE20251), Myoin Society now offers the complete package:Darpan-Registration-Doc.pdf+1

- Tax-free operations for the organization (12A)

- Tax deductions for donors (80G)

- Government recognition and transparency (DARPAN)

How to Donate with 80G Benefits:

- Minimum Amount: Any amount (no minimum limit)

- Payment Methods: Bank transfer, cheque, UPI, credit/debit cards, online payments

- Cash Limit: Maximum ₹2,000 in cash for 80G benefitstax2win

- Receipt: Official 80G receipt provided for tax filing

- Tax Savings: Claim 50% deduction under Section 80G during income tax filing

Our Gratitude:

We thank all our supporters who have believed in our mission from the beginning. With these regulatory achievements—DARPAN, 12A, and now 80G—we are positioned to make an unprecedented impact in the fight against myositis.

Your donations now do double good: advancing critical myositis research while providing you with valuable tax benefits.